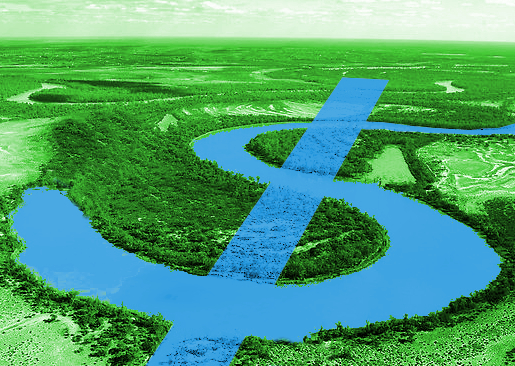

Water exchange suggested

Calls are growing for an ASX-style water-trading market.

Calls are growing for an ASX-style water-trading market.

Proponents say a single trading market with government oversight would give irrigators and the public confidence that market prices move with supply and demand, rather than by the influence of speculators.

There are currently two ways to trade water – buying permanent water rights for amounts allocated by authorities each year, and by trading temporary allocations (water used on-farm that has already been allocated in a given year).

Temporary water prices were over $800 per megalitre this year, much high that the average for the last decade of around $130 per megalitre.

The situation is made more complicated by the broad range of different companies operating their own water trading platforms.

Damian Drum, the Nationals' Federal Member for Nicholls in northern Victoria, has called for a single trading platform for water in the Murray-Darling.

“I think it has merit,” Mr Drum said.

“What everyone wants to see first is absolute transparency.

“So they want to be able to see who owns the water, who just sold it, who did you sell it too, how much did you sell, and what price did you get for it?”

He said water traders and brokers have been caught doing the wrong thing.

“All of a sudden, if were able to see one trader or a broker selling at an inflated price to another trader or broker, and then that water being traded back three weeks later just to force the price up, this is nearly talking about criminal behaviour,” he said.

“So as soon as we get the transparency, we can be a position to clean this up.”

The competition regulator announced an official inquiry into Murray-Darling Basin water markets last month.

Print

Print